News

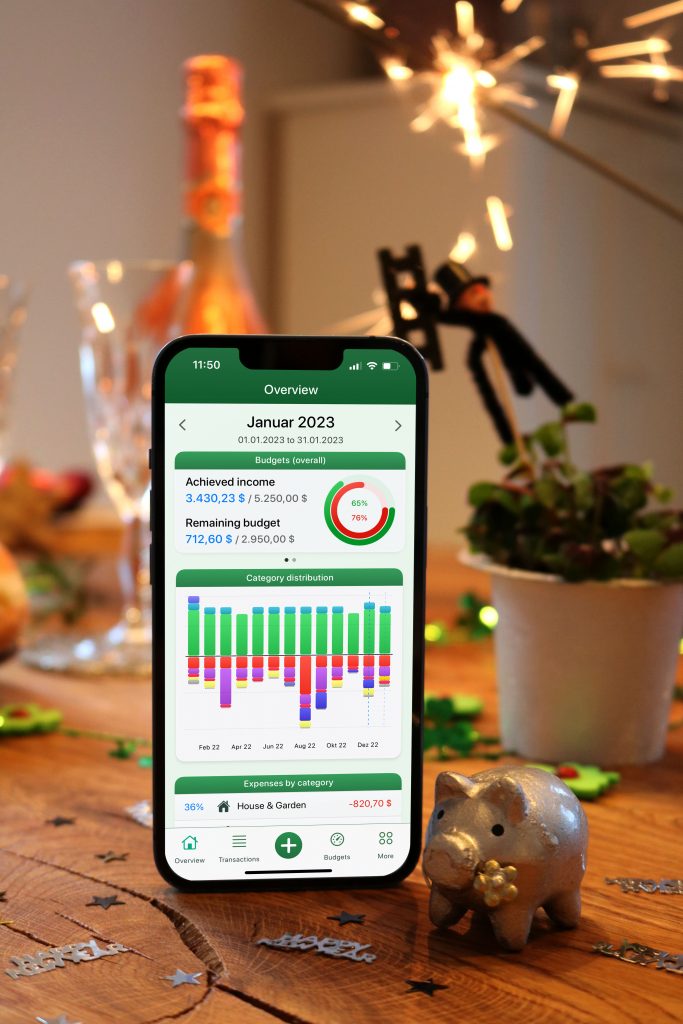

January 1, 2024 – Master Your Finances with MoneyStats in 2024: The Ultimate Solution for Seamless Tracking and Analysis

In the fast-paced world of finance, staying in control of your income and expenses is the key to financial success. Whether you’re a seasoned investor or just starting on your financial journey, understanding where your money comes from and where it goes is paramount. In this digital age, the power to monitor your financial health lies in the palm of your hands, and MoneyStats is here to revolutionize the way you manage your money.

Financial stability begins with awareness. Tracking your income and expenses provides a comprehensive overview of your financial landscape, enabling you to make informed decisions about your spending, saving, and investing. Without a clear understanding of your financial inflows and outflows, it’s easy to find yourself in a cycle of overspending or missed opportunities.

MoneyStats empowers you to take control of your financial destiny by offering a user-friendly platform for effortless income and expense tracking. Say goodbye to the hassle of manual calculations and complex spreadsheets – with MoneyStats, you can visualize your financial picture with just a few taps.

MoneyStats is more than just a budgeting tool, MoneyStats is a comprehensive solution that goes beyond the basics. With its intuitive interface and powerful features, this app makes financial management a breeze.

Connect Your Banks Seamlessly: MoneyStats takes convenience to the next level with its latest feature – the ability to connect your bank accounts directly to the app. Imagine effortlessly importing all your transactions with just a click, eliminating the need for manual data entry. This groundbreaking feature not only saves you time but also ensures accuracy in tracking your finances.

Automated Analysis for Smart Decision-Making: MoneyStats doesn’t just stop at tracking your income and expenses – it’s your personal financial analyst. The app’s robust algorithms analyze your spending patterns, providing valuable insights into where your money is going. Armed with this knowledge, you can make informed decisions about budget adjustments, investment opportunities, and long-term financial goals.

Simplify Your Life with MoneyStats in the New Year 2024: In a world where time is of the essence, MoneyStats emerges as the solution to streamline your financial management process. Embrace the ease of tracking your income and expenses, and let MoneyStats be your guiding light toward financial prosperity.

Don’t let the complexities of financial management hold you back. Join the MoneyStats revolution and take charge of your financial future. Download the app today and experience the freedom of effortless financial control – because when it comes to your money, every detail matters.

May 24, 2023 – Revolutionize Your Financial Management with MoneyStats and Online Banking Integration (coming soon!)

Managing personal finances can often feel like a complex and overwhelming task. However, with the advent of modern technology, individuals now have access to powerful tools that can simplify their financial management and provide valuable insights. One such tool is my personal finance management app, “MoneyStats.” In its latest development, MoneyStats is introducing an exciting new feature that allows users to connect their app with their online bank account. This integration opens up a world of advantages and highlights that will transform the way users manage their finances. In this article, we explore the benefits and upcoming features of MoneyStats’ online banking integration. [Continue reading the article]

January 1, 2023 – Happy New Financial Year 2023!

Congratulations on the new year 2023! As you embark on this new year, it’s important to focus on personal financial management to set yourself up for success. This means setting goals, creating a budget, and making smart financial decisions that align with your values and priorities.

Here are a few tips to help you get started:

- Set clear financial goals: What do you want to achieve this year? Whether it’s saving for a down payment on a house, paying off debt, or building up your emergency fund, it’s important to have a clear sense of what you’re working towards.

- Create a budget: A budget is a plan for how you’ll spend and save your money. It can help you track your spending, identify areas where you can cut back, and make sure you have enough money for the things that matter most to you.

- Make smart financial decisions: This means considering the long-term consequences of your choices, and weighing the costs and benefits of different options. It also means being mindful of your financial situation and taking steps to protect your assets and reduce your risk of financial setbacks.

By focusing on personal financial management, you can make this new year your best yet! Wishing you all the best in 2023.

December 23, 2022 – Start your financial planning for 2023 with a new resolution!

Personal finance is a topic that can often seem dry and uninteresting, but it’s actually a crucial part of our lives. Whether you’re a college student just starting out on your own or a seasoned professional, keeping track of your finances is essential for achieving your financial goals. The new year 2023 offers the perfect chance to start with a good resolution! [Continue reading the article]

October 7, 2022 – Computer Bild dedicates an article to MoneyStats

In the current magazine of Computer Bild (issue 21/2022, page 32) – in Germany one of the highest-circulation and best-selling computer magazines – you will find a successful article about MoneyStats as part of the title topic “Saving energy”! So buy and read quickly! 🙂

You can buy the complete article online or in the next kiosk around the corner!

August 25, 2022 – The new receipt scanner with optimized text recognition software

The current version of MoneyStats now has the new receipt scanner. This has intelligent text recognition software to read the amount, the date and the title from the receipt or the invoice. From this information, a new transaction is created as an income or expense. The corresponding fields are automatically pre-filled. All in just a few seconds and without additional entry work!

In the upcoming update, which is expected to appear in early September 2022, this algorithm has been significantly optimized again. The time, the payment method and the categorization are now also recognized and the localization of foreign languages has been improved. Unfortunately, receipts are not standardized and therefore I depend on your support to further optimize the text recognition for all individual cases and different countries. Many thanks to all supporters for sending in your receipts! It was a great help for me to add the various keywords and special cases and to improve the code significantly!

January 1, 2022 – New year, new resolutions and save money with your financial plan for 2022!

Happy New Year! I wish you all the best for the new year 2022 and all the best for all of your projects. This year there will be many new functions and enhancements for the free budgeting app in the Apple App Store and I look forward to all suggestions for improvement! At this point I would like to thank you for your trust and support in the MoneyStats project!

With the turn of the year the time for new resolutions begins. Therefore, your finances should be put to the test! The synchronization for couples is of course also possible and makes sense, because the goal should always be a complete overview of your household! Keeping a budgeting app can help you with that! So prepare yourself well for the new year 2022 and manage your income and expenses with the MoneyStats app right from the start, so that you gain and above all keep an overview of your finances.

To save money, you should always keep an eye on your finances. Analyze your finances over the last few years and think of certain categories for which you typically spend your money and where you earn money. As soon as your income and expenses are categorized, the worst is done! To go one step further, it is advisable to create budgets for all of your categories. The budgets help you stay within specified limits and save you from unnecessary expenses at an early stage. [Continue reading the article]

December 22, 2021 – Christmas and the financial planning for 2022 are just around the corner

Not only will it be Christmas in a few days, but the big new MoneyStats version 5.0 will also be released! With some cool new features, this is my gift to you! A lot has happened in 2021 and my app has now been downloaded over 1 million times from the Apple App Store and MoneyStats is now available for iOS, iPadOS and macOS. In addition to the many new functions, other languages have also been added, thus promoting internationalization. There is still a lot to do, but I am proud of what I have achieved and look forward to new challenges in the coming year! At this point I would like to thank you for your trust in my financial product, your feedback and the numerous suggestions for improvement that make MoneyStats even better every year.

So that you can look forward to the new MoneyStats version 5.0 today, I will briefly summarize the most important new features. As you can already see in the photo, there is a new view of the category distribution on the overview page. So you can see immediately which categories you spend the most money on each month or where you make the most money. When viewing the transactions, there was always no permanent display of the current account balance, especially with the iPhone models. There is then a new evaluation for this on the lower bar, which you can then even configure additionally. Depending on your requirements, you can have the current account balance or the balance at the beginning or end of the month displayed there. In the financial report there is a new additional section, where the largest income and expenses are listed. The hashtags were displayed better everywhere and partially restructured, so that it is easier to activate or evaluate them for your transactions. But also in many other places small improvements were made and bugs fixed. So keep an eye out and maybe you will discover one or the other innovation! 🙂

I wish you a Merry Christmas with your loved ones and stay healthy and happy! Take a good rest and don’t forget to carefully note the expenses for the gifts and the Christmas goose in the app! 🙂

October 13, 2021 – New MoneyStats update available

With the new update, significant improvements have been made for the new iPhone 13 and iPad mini, but also important changes have been introduced for the new iOS 15 operating system. There are also numerous new functions in the app such as the new credit card function and you can now archive accounts so that you can hide accounts that are no longer used without having to delete them completely. Please read about all the new features in this post (click here).

July 2, 2021 – Your savings rate

Do you want to know how high your savings rate is? In the next update there will be a new view and a new report for this. The savings rate relates the income earned to the savings. The savings rate is a percentage that indicates which part of the income is not used for consumption but for saving. A rate over 50% is extremely good. On average, this is between 10% and 30% depending on the country. I hope the percentage shown is a good motivation to save!

April 1, 2021 – Share your data with family or friends

With the latest version of MoneyStats (iOS version 4.02 and macOS version 2.02 or newer) you can now share and synchronize your financial data with family or friends. You can determine exactly which person will have access to your data and whether this person should only have read access or write access to the data. This means that the long-awaited function for sharing data with different Apple IDs, which is activated with the in-app purchase “MoneyStats Data-Sync”, finally works!

December 26, 2020 – MoneyStats is celebrating its 3 year anniversary

The year 2021 is approaching, the financial planning for the new year is coming and MoneyStats celebrates its third anniversary! That’s enough reason for a big new update at the end of the year! At this point I would like to thank you for your support and your many valuable suggestions for improvement, which make MoneyStats better every year! You guys are great!

With MoneyStats 4.0 there are the following innovations:

- All widgets have been edited and improved! There are now clickable and configurable widgets with dynamic content. On your home screen you can have different budgets or account balances evaluated, make quick entries and choose from a wide range of new widgets!

- PDF files can now also be attached to transactions. There is an additional option for this and for this reason I have renamed the function as “Attachment”. The attachments can of course also be linked to your reports.

- The extended diagrams have been improved and provided with additional information. All bar and line charts can now be clicked, so that an enlarged view opens with further filter options!

- Some buttons, controls and layouts have been optimized for the new iOS 14 operating system.

- Some icons for categorizing have been added and revised.

- New video tutorials in English and German have been created.

- I have replaced the term “group” with “category” throughout the app, as it is more internationally understandable and corrected some translations.

- MoneyStats has been optimized as always and some bugs have been fixed!

I wish you a happy new year and stay healthy!

August 15, 2020 – c’t dedicates an article to MoneyStats

In the current magazine of c’t (issue 18/2020, page 84) – the largest European magazine for computer technology – you will find a successful article about MoneyStats! So buy and read quickly! 🙂

You can see the complete article in the magazine or at the following link on the heise.de website:

July 8, 2020 – Keep a budget and save money!

Who does not know it? The month is not yet over, but the money is already scarce. Therefore, it is even more important to keep track of your money and to control your own finances.

Keeping a budget can help you with this! That is why I am devoting myself today to the topic: “Keep a budget and save money”.

But first of all: What distinguishes a financial overview?

Actually, it’s just an overview that lists your income and expenses in an orderly manner. You can keep this overview, for example, in a book or in an app. But why bother? I can also see my income and expenses in online banking …

… and this is exactly the crux of the matter! It’s not just about keeping track of card payments, it’s also about keeping an eye on cash. The aim is to document the finances fully and transparently and, at best, to categorize them. This is the only way to get a feel for your finances, only in this way will you recognize unnecessary or excessive expenditure, only in this way will you set budget limits and goals. And that’s the only way to save money! And that is exactly the money that you lack at the end of the month.

But how do I start? Very easily. Find a book or an app (for example the “MoneyStats” app) and start systematically recording all your income and expenses. The first step is really just to give you a complete overview of your finances. How much do I take and how much do I spend? Don’t forget the coffee on the go, the annual contracts or outstanding invoices. Write down the date, the amount and the title. The focus should be on completeness. It is best to write everything down for 2 to 3 months. It’s not easy, but the work will literally pay off later.

True to the motto “A picture is worth a thousand words”, it is now time to categorize your income and expenditure. This gives you the chance to graphically evaluate your transactions and thus identify potential savings. So think of typical groups for which you spend your money or groups for which you generate income. You will find that there are mostly more spending groups than income groups. Examples are the income groups salary, pocket money or child benefit. For your spending groups, on the other hand, you could use rent, food, clothing, children, cars, leisure, vacation, electricity, water or telephone.

The work is worthwhile because you have now got an orderly overview. You can do a lot with numbers alone, but they can only really be understood if you visualize them.

It’s about analyzing! Compare your spending over the past few months and try to get a feeling of how much money you are investing in certain groups. Compare your earnings and expenses and analyze exactly what you spend the most money on. Electricity, cell phone and car insurance costs need to be put to the test. For example, if you pay your car insurance monthly instead of annually, you may pay several hundred dollars more a year! Assess your expenses and set priorities. Questions like “Was the new item of clothing really necessary?”, “Do I still need the newspaper subscription?” or “Do I really have to go out to eat several times a week instead of cooking at home?” must be answered appropriately.

But not only look at your expenses, but also take a look at your earnings. Do you have the chance to increase your income or open up new sources of income? A promotion or a job change may give you a higher salary. Finally renounce an unhealthy vice? Or muck out the basement and turn hidden treasures into money. Have you already submitted an annual tax return? As you can see, there are many ways to ring your cash register.

Now that you’ve got an overview of your income and expenses, it’s time for your budget! So set yourself a financial limit for certain spending groups and try to meet this over the month. For example, set a monthly limit for clothing and leisure expenses. Similarly, you can of course also create budget goals for your revenue groups.

And now it’s up to you to bring your personal finances on track! Watch your finances, keep your budgets, and you’ll quickly notice that even money remains at the end of the month.

March 27, 2020 – MoneyStats is now available for Mac!

It took a while, but now MoneyStats is available for all macOS devices. The functions are the same as on the iPhone and iPad! And the synchronization between iPhone, iPad and Mac works without problems.

March 27, 2020 – The new website goes online!

It was time to give the old website a new shine. Therefore, I decided to use a content management system (CMS) to better inform about innovations and changes.